Buyclomidonline.shop – Washington Mutual Car Insurance. Select one of the options below to view service providers in your state or change your zip code

PEMCO Insurance Company’s rating is based entirely on customer reviews. The rate is determined using an algorithm that analyzes various inputs for our insurance clients:

Washington Mutual Car Insurance

The algorithm takes into account the percentage of customers who say PEMCO Insurance Company is good.

Washington County Farmers Mutual Fire Insurance Company

PEMCO is a Seattle, Washington-based insurance company that serves customers in Oregon and Washington. Founded in 1949, PEMCO offers auto and home insurance as well as many other specialties to give you the protection you need.

Car insurance rates vary based on many factors that are unique to you, your car, and where you live. Some of the factors that affect the cost of car insurance include the car you drive, your credit score, where you live, your driving history, and the company you choose to get your policy from. In the chart below, you can see the cost comparison of PEMCO car insurance for an adult compared to the cost of car insurance in Washington.

PEMCO auto insurance rates for adults are much lower than average auto insurance rates in Washington. Please note that this is a car insurance rate based on your specific profile and your rates may be higher or lower depending on the unique features that affect your car insurance rates.

Different parts of the United States have different risk factors, and these factors can affect the cost of home insurance. For example, Washington state is prone to earthquakes. While your location and natural disaster risk factors will affect your homeowner’s insurance rate, there are many other factors, including the location of your home, the condition and age of your home, and the size and type of home. your, crime rate in your area, crime rate, etc. Your application history and credit score. In the chart below, you can see the price comparison of PEMCO homeowner’s insurance compared to other homeowner’s insurance in Washington. The chart is divided into two categories: homes priced at $200,000 and homes priced at $400,000.

Cheapest Car Insurance Quotes In New Hampshire For 2023

The average PEMCO homeowner’s insurance coverage for a $200K and $400K home is significantly lower than the average homeowner in Washington. Please note that these are average homeowner insurance rates based on individual profiles and your rate may be higher or lower based on your unique circumstances that affect homeowner insurance rates.

PEMCO auto insurance quotes are based on the profile of an adult with a PEMCO auto insurance policy. The same adult rate is based on the profiles of older drivers aged 35 and over who have not had a driving problem in the past 3 years. The vehicle used was a Toyota Highlander LE 2015. Comprehensive insurance used limits 100/300/50 with $500 collision and general deductible. The driver had a good credit score.

The average rate for Washington state shown in the graph is based on the average rate of auto insurance from the largest companies in Washington and based on the same profile of an older adult. All prices shown should be used for comparison purposes only, as prices vary. Financial information is provided by Quadrant Information.

The average cost of PEMCO homeowners insurance is based on two different profiles for PEMCO homeowners insurance policies.

Introducing Limu Emu And Doug, The Dynamic Duo Of The Insurance World Starring In New Liberty Mutual Ad Campaign

The Washington state average shown in the graph is based on the average rate for homeowners from the largest companies in Washington and is based on the same two profiles. All prices shown should be used for comparison purposes only, as prices vary. Financial information is provided by Quadrant Information.

Please note: PEMCO sells insurance in Oregon but the rate information on this profile is not available for auto and homeowner’s insurance in Oregon.

PEMCO Insurance Company offers an agent on iOS and Android devices that allows customers to view IDs, change policies, make payments, view claims, view details and access customer support.

Before making a final decision on your insurance company, it is important to learn as much as possible about local insurance providers and the coverage they offer. Call your local insurance agent to address any questions you may have. Questions to ask, “What is the best coverage plan for me/my family/my situation?” “What are the minimum requirements in my state and what type of insurance do you offer?” “If I take out auto insurance and home insurance with you guys, do you offer a product?” “”What is the average rate of insurance guys you offer? ”

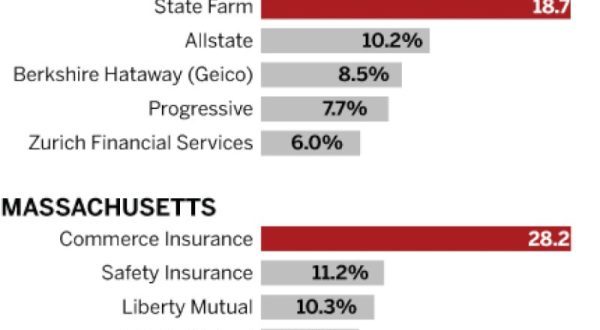

State Farm Stays Out Of Mass.

Before making any insurance decisions, use our free tool to compare insurance prices near you. It’s easy, just plug in your code and we’ll do the rest!

PEMCO Insurance Company sells auto, homeowners, renters and motorcycle insurance in state 2. See what state PEMCO Insurance sells and click online to see how PEMCO Mutual Insurance Company compares to other leading companies in that state .

You can learn more about the company by reading the PEMCO Insurance Profile. Or share your experience with our community by writing a PEMCO insurance company review. Home » Compare car insurance rates by state

Compare Washington Car Insurance Rates [2023] How much does it cost to compare car insurance in WA? Payment is $50 per month. The minimum auto insurance Washington requirement is 25/20/10 for bodily injury and property coverage. We’ll share how to compare Washington car insurance to find the best coverage at the cheapest price.

Metro Proposes Train Turnbacks, Fare Changes To Bridge Budget Gap

Laura Berry has experience as a licensed producer selling life, health and property insurance for Allstate and Farmers Farm. He has devoted countless hours to helping his clients understand the insurance market and find the best auto, home and health products for their needs. Currently helping businesses benefit from R&D tax…

Joel Oman is the CEO of a private equity firm backed by a media company. He is a Certified Entrepreneur™, author, angel investor and entrepreneur extraordinaire, creating books and businesses. He also previously founded and resides CFP® for Real Time Health Quotes, a national insurance agency. He holds an MBA from the University of South Florida. Joel…

Marketing awareness: We strive to help you make the right auto insurance decisions. Shopping should be easy. We are not affiliated with any auto insurance company and cannot endorse any claims made by any company.

Our affiliates have no influence on the content. Our opinions are our own. Please enter your code above to use our free tool to compare quotes from major car companies. The more words you compare, the more likely you are to save.

Car Insurance Options & Quote

Writing Instructions: We are a free online resource for anyone who wants to learn more about auto insurance. Our goal is to be the one-stop shop for all things auto insurance. We update our website regularly, and all content is reviewed by auto insurance experts.

Whether you’re heading to the beach or the many parks and forests of the beautiful Evergreen State, you should make sure you carry the right auto insurance policy for peace of mind.

With so many options on the market, our guide will help you make the perfect decision on the best auto insurance policy to fit your needs so you can spend less stress and more fun on your drive to Mount Rainier National Park.

You can compare Washington car insurance rates from insurance providers in your area by entering your zip code into the free tool.

Case Study Very Important

In order to purchase the best insurance coverage specific to your driving behavior, you need to understand the different types of insurance and their associated costs. To help you make an informed decision, we’ve put together a guide that includes key insurance basics such as minimum insurance requirements, liability protection, additional coverage, and how Washington’s rates compare to other states.

What is the minimum auto insurance required in each state? It is important to know how these requirements are similar or different in Washington compared to other states.

Does Washington state require auto insurance? Washington is a no-fault state, which means less auto insurance coverage is required. A driver is required by state law to carry a minimum of auto insurance. The electronic certificate is accepted as proof of insurance in the parking lot.

- Washington Mutual Car Insurance - October 19, 2023

- Use Of Life Insurance In Estate Planning - October 19, 2023

- Best Health Insurance Plans For Families - September 25, 2023

INSURANCE buyclomidonline.shop – INSURANCE

INSURANCE buyclomidonline.shop – INSURANCE