Buyclomidonline.shop – Individual Vs. Group Health Insurance. Taking out a medical insurance policy is not something that should be done carefully. When taking out such a policy there are a number of aspects that you must keep in mind, including what you expect from your policy and your monthly budget. It is also very important that you consider what type of medical insurance policy you need to get.

There are a number of policies available to you in relation to your chosen health care plan, two examples of which are private medical insurance or group medical insurance. Every policy has a group of services available to you and this is no exception. However, deciding whether to choose a private or group policy is one of the most important decisions you can make regarding your health care coverage.

Individual Vs. Group Health Insurance

So what are the differences between the two and which one will benefit you the most? The biggest difference between these two medical insurance policies is how they are offered. A private plan is something you take out for yourself, while a group plan is provided to you through your service. In some cases, you may not even have a choice between these two policies; you should choose this as employers may not offer you group insurance.

How Much Does Health Insurance Cost?

Although it is important that you take out a policy that gives value for money, it is more important that that policy covers you for most of the difficulties that you may face, but what if there is an option you between the two?

There are several benefits to getting a group medical insurance policy, for example, you are offered lower premiums, better tax breaks and increased coverage and best of all almost every business owner can offer you. With this type of medical coverage, your premiums will be determined primarily based on your job and other employees, rather than your health care background. Factors such as the average age of employees and the nature of your work as well as the history of illness among employees will be taken into account. The biggest reason to get this policy is definitely the amount of money you would save, so why should you consider taking out a private policy?

Importance of Life Insurance Policy Life insurance protects anyone who is economically dependent on you. If you die suddenly, New Braunfels TX life insurance provides money that…

Choosing the Right Life Insurance in New Braunfels, TX Choose the right life insurance to protect you and your family. We listen to your needs and tailor a plan to suit…

Best Benefits Of Group Health Insurance For Startups In India

10 Seconds That Ended My 20 Year Marriage It’s August in Northern Virginia, hot and humid. I still haven’t showered from my morning ride. I’m spending my stay at home mom…

The ChatGPT hype is over — See now how Google will kill ChatGPT. It doesn’t happen immediately. The business game is longer than you know.

The Most Powerful Morning Routine I Found After 3+ Years of Experimenting A Realistic, Science-Based, Adaptable, Aggressive Self-Testing Morning System

Understanding the growing importance of cyber security in the insurance industry: Why insurance … As the insurance industry continues to embrace digital transformation, the importance of cyber security cannot be overstated. With the … Medical costs have skyrocketed, and you need a solid plan to avoid financial distress. A medical emergency can bring financial uncertainty and create a stressful situation. Health insurance is your salvation during such situations. But which one is more useful for the need, a group health insurance or a personal plan?

Self Funded Insurance Plans 101

When you think of health insurance, two names come to mind. One is the employer health insurance, and the other is the individual health insurance plan. Both are policies that cover health and medical expenses depending on the sum assured and the policy benefits. But there is a lot of difference in the two plans. If you are in doubt about the features of the plans, read them quickly to eliminate all the doubtful questions.

A group health insurance plan or employer health insurance is an employment benefit offered by the organization’s employer to its employees. Under this plan, the employer is responsible for paying the premiums and the employee and their dependent family members can avail policy benefits. In contrast, individual health insurance is a personal purchase to enjoy medical benefits. Here you buy the policy and pay the premium according to the chosen plan.

Although the main function of both policies is to bear the medical expenses during emergencies, there are many differences between the policies.

In both the policies, you have to pay a premium to avail the coverage benefits. In individual health insurance, the policyholder is responsible for paying it. They can choose the plan according to their affordability and pay premium from their end to continue the insurance benefits. In contrast, the employer is the decision maker in the case of a group health insurance policy. The policy and the amount of insurance is determined by the employer of the organization or business you are a part of. They pay the premium for you, and the employees can enjoy the benefits of the plan without paying a cent for the policy.

Indiana Health Insurance

Insurance coverage is the basic utility, why most people sign up for health policies. By showing the insurance card, the policyholder can be admitted and treated. The insurance cover also allows reimbursement of medical expenses if you present genuine relevant documents. But there is a difference in the two policies in terms of plan coverage.

In case of individual health insurance, only the policyholder can enjoy the benefits. If the insurance plan is under your name, you can enjoy the cover. No one in the family or dependent members can enjoy the coverage benefits. When you’re in a group health plan, you get comprehensive coverage. In the employer’s health policy, you and your family members including spouse, children and parents can enjoy the covered benefits.

Retirement criteria in a health insurance policy means the term of the plan’s coverage. This is the period until the insurance company pays the cost of your medical expenses in exchange for the premium payment. On the other hand, termination of a health plan means when the policyholder surrenders the policy and stops paying the premium. The regulations for surrendering the policy and the exit procedure are different in the two health insurance plans.

In an employer health insurance plan, the policy is valid until the period of active employment. This means that if an employee leaves the job, the benefits of the plan will be cancelled. Here, an employee cannot stop the premium payment if they wish and will continue to receive the plan’s coverage until the last day of their employment. In contrast, with an individual plan, the decision is entirely yours. You can terminate the plan by not paying the premiums or handing over the papers to the insurance company. The retirement criteria of personal plans may vary depending on the norms of the insurance company.

Advantages Of Group Medical Insurance

To become a policyholder, there are several eligibility criteria in both the insurance plans. If you do not meet any of the eligibility norms given in the selected insurance plan, your policy will not be approved. The best way to find out if you are eligible to buy the insurance or not is to contact a representative of the insurance company or consult an insurance broker.

In an employer health insurance plan, the eligibility criteria are more complex. As an employee of an organization, your eligibility criteria is to remain a full-time member of staff in the organization or business. Only then can you take advantage of the benefits. As an employer who wants to provide the policy benefits to their employees, you need to tick certain rules laid down by the IRDAI. For example, the minimum number of employees must be seven to get approval for the group’s health policy.

In contrast, personal health plan eligibility is straightforward. You must be an adult (18 years old) to put the policy in your name. For health policies for minors, there should be a legal guardian to take responsibility for the premium and other necessary formalities.

The sum assured in the health policies may vary depending on the plan you choose. In group health policies where the employer is the main decision maker, they decide the amount. The amount is lower than individual policies and usually varies between Rs.1 lakhs and Rs.5 lakhs.

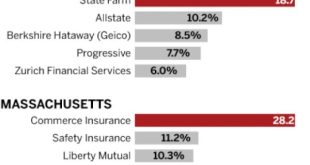

Health Insurance Coverage In The United States

On the other hand, in personal health policies, the sum assured is much higher as the policy holder decides the amount for their treatment. Usually, the average range under which most personal policies fall is Rs.5 lakh to Rs.15lakhs.

Customization of health policies means the scope to add plan benefits or increase the sum assured. The determinant of the policy plans is different from the employer and personal insurance, so the scope of customization is also generally different.

The employer (policyholder) has the option to choose the benefits/coverages as within a defined category of employees

Individual health insurance arizona, group vs individual insurance, individual health insurance ohio, individual health insurance nevada, humana individual health insurance, individual health insurance texas, purchasing individual health insurance, get individual health insurance, individual health care insurance, group vs individual health insurance, individual group health insurance, individual health insurance virginia

- Washington Mutual Car Insurance - October 19, 2023

- Use Of Life Insurance In Estate Planning - October 19, 2023

- Best Health Insurance Plans For Families - September 25, 2023

INSURANCE buyclomidonline.shop – INSURANCE

INSURANCE buyclomidonline.shop – INSURANCE