Buyclomidonline.shop – Use Of Life Insurance In Estate Planning. I started Insurance Blog by Chris™ because I have a passion for insurance. Here at the blog, our job is to educate and inform people about the best insurance for them. Since then, we have grown into a national brand with a large research team helping people understand all types of insurance.

Angie Watts is a licensed real estate agent with Florida Executive Realty. Angie has been specializing in real estate since 2015 and is a real estate writer who has published a book teaching homeowners how to make the most money when selling their home. His goal is to educate and empower both home buyers and sellers to have a stress-free buying and/or selling process. You have class…

Use Of Life Insurance In Estate Planning

Advertiser Disclosure: We strive to help you make insurance decisions with confidence. Comparison shopping should be easy. We are not affiliated with any individual insurance provider and cannot guarantee quotes from any individual provider.

Ways Life Insurance Can Soften The Blow From Recent Legislative Tax Proposals

Our cooperation in the insurance industry does not influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your postcode on this page to use the free quote tool. The more quotes you compare, the more likely you are to save.

Application Guide: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for all things insurance. We update our site regularly and all content is reviewed by insurance experts.

In April, in the US, everyone is thinking about taxes and believe me, they are NOT happy thoughts!

Another unique way to reduce the tax burden that must follow when one dies is to use life insurance as part of a well-thought-out estate.

How Life Insurance Can Help You With Estate Planning (2023)

Less than 1% of estates will owe federal estate tax in 2019, and that’s because you can leave millions of dollars to your heirs before the tax event hits. The exact amount you can leave behind is the Federal Tax Exemption amount, which we’ll cover in the next section.

If your estate owes federal estate tax, however, it must be paid to your estate (by your executor or trustee) within 9 months of your death.

If your estate consists mainly of a business or real estate, or other unsaleable assets, and you will owe taxes, that is another good reason to consider life insurance. Life insurance provides quick, liquid money that can be left to your estate (or trust) to pay taxes that your estate cannot easily cover.

Individuals can die and leave up to $11.4 million (for a married couple, that doubles to $22.8 million) without their heirs incurring inheritance tax.

Life Insurance And Nontaxable Estate Planning

This is known as the “federal tax credit” amount, and it changes (usually increases) almost every year.

You are generous, aren’t you? We pay taxes on everything, but apparently very few of us will pay federal taxes if the exemption rate stays this high!

It is true that with the current 2019 version of 11.4 million per person, only the rich should be concerned about it.

– but with tax rates as high as 40%, the wealthy should definitely plan early so that their inheritance is not cut short by federal estate taxes!

What Is Estate Planning And How Does It Work? (2023)

However, if you haven’t used life insurance to reduce the impact of taxes on your estate, now would be a good time to consider it.

Why should your family come up with a big tax bill when you can buy life insurance and pay pennies on the dollar now to pay that premium?

You’ll never get any younger than you are today, so the cost of life insurance to protect your legacy will never be lower.

If you’re married, a Second Death policy may be right for you—and it’s more affordable than two individual policies. Since no estate taxes are collected until after the death of the second spouse, this unique strategy can make perfect sense.

Understanding Life Insurance Policy Ownership

Universe, and some of its value will remain intact. You can choose to use the annual gift tax deduction to fund the fund, knowing that only those funds can be used for the non-refundable life insurance premium.

In the previous section, we mentioned that you may want to take steps to avoid including life insurance premiums in your taxable income.

Before you go to buy such a life insurance policy, it is important to understand how ownership of the policy is an important decision.

For example, to avoid being included in your federal lien, you must have no ownership incident—you must not own the policy and you must not have any control over the policy. (Of course, you’ll want to discuss this with an attorney to make sure it’s done correctly.)

Including Life Insurance In Your Estate Plan

It’s also important to choose a reliable life insurance company – not the one with the cheapest interest rate, but the one with the insurance company.

An independent life insurance agent can help you find the right carrier and product for your estate planning needs, and it’s just one click away!

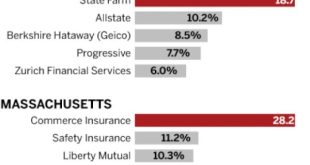

While federal estate taxes are only a problem for the wealthy (11.4 million estates are exempt from federal tax, or 22.8 million married couples), remember that “estate taxes” are still required in 12 states and the District of Columbia — according to Balance.

– and with housing prices as they are today – thousands and thousands of elderly taxpayers will fall into this category.

Five Estate Planning Myths

Some states also impose inheritance taxes on multiple heirs. Although many states are relaxing their estate tax guidelines, according to The Balance, at least 6

The laws in each country are different when it comes to inheritance taxes, the highest rates are usually around 15%-18%. Some offer exempt amounts (for example, the first $40,000 of the value of an inheritance sent to a son or daughter is exempt in Nebraska).

States may also have variable tax rates based on the beneficiary’s relationship to the deceased. For example, in Nebraska, a close family member will only pay 1% estate tax after the exemption amount, while an unrelated friend will pay 18%.

Either way, life insurance can be the perfect solution so that your heirs are not forced to sell your assets immediately to meet estate or inheritance tax obligations.

Yours, Mine, And Ours: Estate Planning And Life Insurance For Second Marriages

Click here for a FREE quote and answers to all your questions about how to plan your estate using life insurance.by Jason Mericle | June 1, 2022 | Estate Planning, Irrevocable Life Insurance Funds, Planning Ideas, Premium Funded Life Insurance

When it comes to estate planning, life insurance can be an important tool for high net worth individuals and families. Typically, life insurance is used to help provide for estate taxes, provide home equity, cover ongoing expenses, and help maintain the continuity of a private business.

High-value life insurance planning is the process of creating an estate plan that includes life insurance as a tool to help you pass your wealth to your heirs in a tax-efficient manner.

Life insurance can help families avoid foreclosing or accessing assets to pay estate taxes, expenses and other obligations. It can play an important role, especially if the property has houses or other illegal assets that are not easily converted into cash.

Estate Planning And Life Insurance — Sss Law: Huntsville Estate Planning

Without proper planning, your life insurance could end up in your estate paying estate taxes.

One of the most common reasons high net worth families choose to purchase life insurance is to provide funds to pay some or all of their estate taxes.

Estate tax is a type of tax that is levied on the transfer of property when a person dies. Inheritance tax is calculated based on the value of the property when the person dies.

By 2022, each individual has an estate tax exemption of $12,060,000. That’s $24,120,000 per pair. Any amount in excess of the exemption will be subject to a 40 percent estate tax.

Using Life Insurance To Ensure The Long Term Viability Of Your Business

Under current law, on January 1, 2026, the estate tax exemption will revert to $5.49 million, adjusted for inflation.

In addition to the federal estate tax, there are 17 states that have an estate or inheritance tax. Taxable property values also vary from state to state. Click here to find out if your state requires an estate tax or inheritance tax.

One of the main advantages of using life insurance for estate planning is that death benefits are usually tax-free.

However, individual ownership of life insurance will result in the death benefit being included or added to the insured’s estate. Thus, the death benefit is subject to an estate tax rate of 40 percent.

Does Life Insurance Play A Role In Estate Planning?

An Irrevocable Life Insurance Trust (ILIT) is a type of trust established to own and be the beneficiary of one or more life insurance policies.

There are several benefits associated with using an irrevocable life insurance company in estate planning, including the ability to reduce estate taxes, avoid probate, protect creditors, and provide financial security to loved ones.

Creating an irrevocable life insurance trust begins with having it written and executed. This should be done by a qualified lawyer.

- Washington Mutual Car Insurance - October 19, 2023

- Use Of Life Insurance In Estate Planning - October 19, 2023

- Best Health Insurance Plans For Families - September 25, 2023

INSURANCE buyclomidonline.shop – INSURANCE

INSURANCE buyclomidonline.shop – INSURANCE